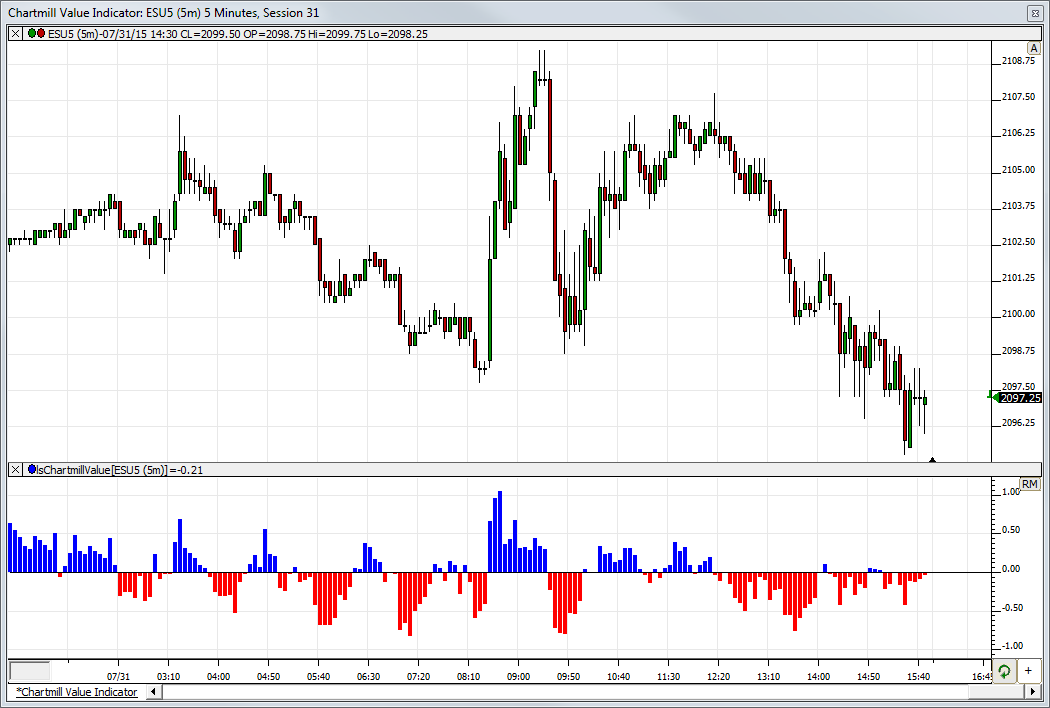

The Chartmill Value Indicator(CVI) appeared in the January 2013 issue of Technical Analysis of Stocks and Commodities. The article was written by Dirk Vandycke. The CVI represents a standard deviation from a moving average, which can be applied to any price series over any period. The concept is simple. As prices rise, they will eventually rise above a moving average. Eventually, the moving average will begin to rise as well. At this point, prices need to continue to rise to increase the spread between the current price and the underlying moving average. When prices begin to level off or consolidate, the spread will begin to decline as the moving average continues to rise.

This may sound a lot like a simple price spread from a moving average however with CVI, the spread is divided by the average true range, which makes its value dependent on both the price level and volatility of the underlying security. This formula makes it very difficult for the deviation from a moving average to remain in the overbought or oversold regions for extended periods, which represents a significant improvement over other oscillators such as the RSI and Stochastic indicators.

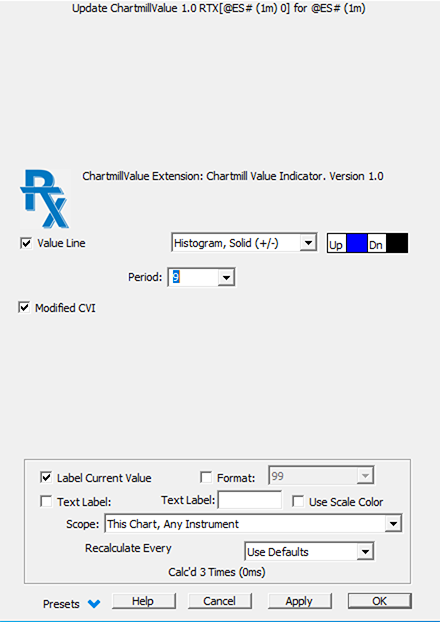

Presentation