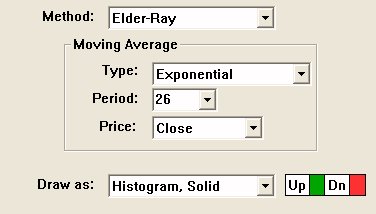

Elder-Ray Method "Elder-Ray" is a technical analysis method developed in 1989 by Dr. Alexander Elder. Dr. Elder, a medical doctor by training, chose the name "Elder-Ray" as a parallel to "X-Ray", since the purpose of the analysis is to look beneath the surface of the market. An exponential moving average (EMA, 13-period) and two other technical indicators, called Bull Power and Bear Power are used in the analysis. Bull Power is simply the difference between the high of each bar and the EMA, while Bear Power is the difference between the low of each bar and the EMA. Both indicators are usually drawn as oscillators (histograms). Bears are strongest when Bear Power is most negative. Bulls are strongest when Bull Power is most positive. The Investor/RT implementation of Bear and Bull power allow you to select other moving average types if you like and to alter the averaging period as well. Elder uses 13-period exponential averages. For a complete discussion of Elder-Ray, see Dr. Elder's text, "Trading for a Living", pp 220-227. To setup an Investor/RT chart for Elder Ray analysis, create a bar chart of daily periodicity and add a 13-period exponential moving average to the bar chart pane. Then add both Bull Power and Bear Power technical indicators, each to a new pane, below the instrument pane. Save the chart as "Elder-Ray Daily" for future reference. Elder describes four conditions for the strongest buy signal:

- The trend is up, i.e. the EMA is sloping upward.

- Bear Power is negative but is rising.

- The latest peak in Bull Power is higher than the previous peak.

- Bear Power is rising from a bullish divergence.

A bullish divergence here would be a period when price is declining to a new low while the Bear Power makes a higher (less negative, less bearish) bottom and begins rising.

Livshin Method Technician Igor Livshin defined Bear Power as the average of the following three values:

- The ability of bears to reduce the price from the opening price to the lowest price. (HI - OP)

- The ability of bears to reduce the price from the highest price to the closing price. (HI - CL)

- The ability of bears to reduce the price from the opening price to the closing price. (OP - CL if OP > CL, zero otherwise)

He goes a step further to define his "Balance of Market Power" (BMP) to be the difference between the Bull Power and the Bear Power (BULLP - BEARP).

The Investor/RT Bear Power indicator gives the user the ability to optionally smooth these resulting raw Bear Power values. If no smoothing is desired, specify a smoothing (MA) period of 1.

Gimelfarb Method Technician Vadim Gimelfarb derived a method of computing Bear Power which was based on determining a maximum movement achieved by the bears. Five prices are consider in the evaluation: Open (OP), High (HI), Low (LO), Close (CL) and Previous Close (CL.1). From Previous Close to Close, there are a potential of 4 movements between prices, from CL.1, to OP, then to HI/LO, then to LO/HI, then to CL. The key is to determine whether the HI or LO occurred first. This is determined using the following rules:

- If OP > CL: we assume LO occurred first. (Since it's closer to OP than it is to CL)

- If OP < CL: we assume HI occurred first. (Since it's closer to OP than it is to CL)

- If OP = CL AND HI - CL > CL - LO: we assume the LO occurred fist. (maximum price movement was gained by the side that was more successful at the close)

- If OP = CL AND HI - CL < CL - LO: we assume the HI occurred fist. (same logic as above)

- If OP = CL AND HI - CL = CL - LO AND CL < CL.1: we assume the HI occurred fist. (maximum price movement was gained by the side that was more successful at the close in relation to previous day's closing price)

- If OP = CL AND HI - CL = CL - LO AND CL > CL.1: we assume the LO occurred fist. (same logic as above)

- If OP = CL AND HI - CL = CL - LO AND CL = CL.1: Bull and Bear Powers are equal at this point (no logical path, just use HI - OP for value).

The Bear Power is then find the maximum "bearish" (downward) single price movement. If the path from CL.1 to OP is downward, and the path then continues downward from OP to LO, then the price movement from CL.1 to LO is considered as one single price movement. If, on the other hand, the path moves from CL.1 down to OP then up to HI, then two movements are considered separately, a bearish movement from CL.1 to OP followed by a bullish movement from OP to HI.

The Investor/RT Bear Power indicator gives the user the ability to optionally smooth these resulting raw Bear Power values. If no smoothing is desired, specify a smoothing (MA) period of 1.

Presentation

Keyboard Adjustment

The Bear Power Moving Average Period can be adjusted directly from the keyboard without having to open up the preferences window. Just select the indicator and then hit the up or down keys on your keyboard to adjust the period. The up arrow key increases the period by 1 while the down arrow key decreases the periods by 1.