Moving average channels use a moving average of price to create an envelope above and below the moving average line at a user specified number of standard deviations. The point of this study is to create a channel which represents support and resistance at its outer bounds based on the moving average. As always, the period of the moving average should match the trading time horizon of interest to the user. As price moves above its n-period moving average, a bullish indication is noted. Conversely, a price move below its x-period moving average is a bearish event. Using standard deviation to create a boundary above and below the moving average attempts to give the user a handle on how far the price has moved from the moving average in the past. The following approximations offer a few rules of thumb for using the standard deviation settings: Plus or minus one standard deviation takes in 68.3% of all expected outcomes Plus or minus two standard deviations takes in 95.4% of all expected outcomes Plus or minus three standard deviations takes in 99.7% of all expected outcomes In other words, you would expect to see a price move outside the moving average band using: one standard deviation: 1 in 3 chance two standard deviations: 1 in 20 chance three standard deviations: 1 in 370 chance

Using a standard deviation which includes 99.7% of all possible occurrences sets levels in the study which may never be tested. You may enter decimal numbers which enable you to adjust the sensitivity of the bands. Note that the standard deviation is a "moving standard deviation". The user may specify the period to use for the standard deviation calculation, usually, but not necessarily the same period as the moving average itself.

Presentation

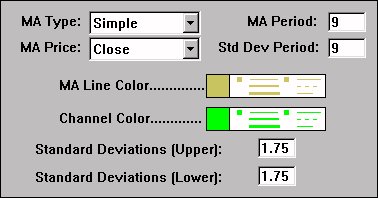

Above is a 5 Minute Candlestick Chart of an Intel Corporation (INTC). The olive center line represents a Simple 9 Period Moving Average of the closing price, while the two green lines represent two channels based on the standard deviation settings in the preferences below. The Preferences