It's that time of the quarter (or month), time to roll over your futures contract to the new month. At the time of editing this topic, ES June 2024 (M4) is about to expire and ES September 2024 (U4) is becoming the new front-month contract. To keep relevant long term view analysis (especially the one involving Volume profile), the vast majority of our users wish to remove the gap created in the continuous contract (@ES#) data when a contract rolls over. Let's review this simple procedure:

1) You are using a brokerage datafeed as a main data source (Rithmic, CQG, Gain, IB) together with the DTN MA historical service

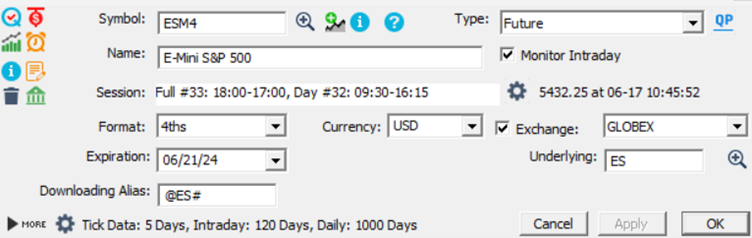

Let's assume you are using Rithmic (the procedure for other brokerage is similar, only the symbol name might be different). In this case your current ES symbol is ESM4 and your instrument setup looks typically like this, i.e. you are using the DTN MA back adjusted continuous contract (ES#) to access a set of continuous historical ES quotes

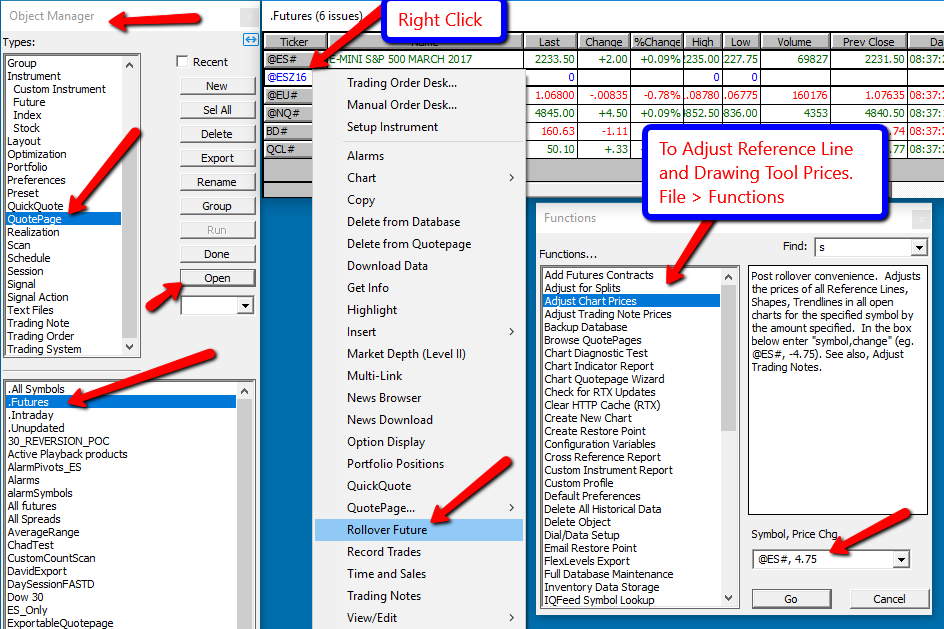

- Step One : Open the default ".futures" quotepage , Right click on ESM4 and select "Rollover Future" on the menu list

- Step Two : on your usual charts, change the instrument to the new front month contract (ESU4), right click on an empty space of the chart and select "Download data > Full data"

Note : if your Investor/RT tick data retention is higher than 5 days, this full download is best completed before the opening of the US cash session. Indeed, during the cash session, in order to keep a smooth access to their historical data server, only a maximum of 6 days of tick data (compared to the 180 days available) can be downloaded from DTN servers (there is no limit on the number of data for 1 min bar data that can be downloaded during the cash session).

IMPORTANT

when @ES# starts returning as live data the new front month contract, this means that all the past historical data associated with that symbol has been adjusted. A “full data” download will erase all past ticks and 1 min data that was stored in your database and replace them automatically with a new set of data, all with premium back-adjusted quotes

2) You are using DTN IQ feed as your primary data source (and executing trades towards one of the order routing system supported by Investor/RT)

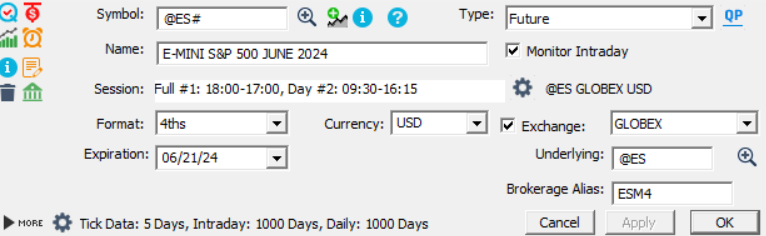

In this case, you most likely have the following instrument set up, ie your main symbol is the DTN continuous contract (@ES#) and you have indicated your “broker symbol” for order execution (ESM4 in the case of Rithmic)

Whenever @ES# starts tracking the new front month contract (this can be directly confirmed by looking at the contract “name” associated with @ES#), you would typically start trading the new front month contract and update the “broker symbol” accordingly (ie to ESU4 in the above example). At that stage, you would need to also do “full data” download so that all past historical data is brought in sync with the current month contract.

Tips for DTN IQ feed subscribers: to update all “brokerage alias” with ease, just open the default “.futures” quotepage, add the “Broker symbol” column (by right click on any existing column title) and directly edit the symbol name there

When should I perform the rollover ?

On your instrument settings window, you can see the expiration date of the current front month contract. Ie the last day this instrument will be traded. Practically, depending on the future market, the actual “rollover date” (ie when the majority of the traded volume move to the new front month contract) takes place 3 to 5 days before the expiration date. Review this rollover calendar to find the exact rollover date of the most commonly traded US futures contracts

For DTN MA subscribers, relying on the DTN continuous contract for their backfill (@ES#), we do recommend, a few days before the expected rollover date (from M4 to U4), to temporarily modify the DTN “Downloading Alias” to the current front month contract (that is about to be rollover). This would mean replacing @ES# by @ESM24. This way, when you open IRT, the automated backfill (activated by default) will recover the latest quotes from the M24 contract.

When you decide to proceed with the rollover, switch back the “Downloading alias” to @ES# and proceed as previously detailed. Please note that DTN uses a 2-digit format for the year, ie DTN contract symbol for the ES June 24 contract will be @ESM24 (while brokerage datafeed typically uses a single digit for the year).

Will my historical market levels and/or reference lines be automatically updated whenever I start using my current chart with the new front-month contract?

The majority will be automatically updated, but there are in fact two scenarios depending on the way these levels were generated

If these levels are created through an indicator relying on past historical data, then all will be updated based on the new set of premium back-adjusted data (that will have been recovered through the “Full data download operation”). So you have nothing to do to adjust these levels. This is typically the case for :

- All market levels generated by the SessionPrices indicator

- LVN, HVN, or naked VPOC displayed through Profile indicators

- TPO singles displayed with the MPH indicator

- Any references line based on a custom indicator value or a V# variable being updated through one of the previous indicators (or updated by any other technical indicator having a "Store current value into V#" feature)

On the other hand, if you have manually drawn (for ES M4) trendlines, used the rectangle, shapes or PriceBoxProjections indicators or introduced manually (within a reference line indicator) a fixed price, these indicators won’t have to be synchronized to the new set of historical quotes linked to ES U4 quotes. To do so, you need to run the investor/RT post rollover “Adjust chart prices" utility (accessible through the "file > function" menu")

- Open at once all ES U4 charts that still include such non-adjusted drawing tool indicators or reference line

- Go to file > functions > "Adjust Chart prices" and type ESU4,xx with xx being the price amount to be shifted, ie this should be the settlement price differential between U4 and M4 contract at the Close of the rollover date.

What if I don’t wish to have premium back adjusted adjusted historical data ?

Auto-adjusted backfill data for continuous contracts for those downloading from DTN is turned on by default in Investor/RT. If you prefer to keep the contract value as there were quoted at the time (and keep the gaps at the rollover date), please refer to this page