Specially designed for Investor/RT users relying on a brokerage feed (Rithmic, CQG,..) as primary real time data source, DTN Market Access is a historical data backfill service marketed by Linn Software.

Why would I need it?

Many of the most valuable Investor/RT features do require data sources providing precise historical and real time tick by tick information ; this is the case for Bid/Ask powered indicators (such as the Volume Breakdown powering "Delta" type of analysis), Volume profile or Footprint indicators and for of all non-time related chart periodicities (such as renko or range bars, reversal tick charts, etc).

Such a tick by tick granularity is typically not available with brokerage companies (such as Interactive Brokers) or web-based providers (such as TradingView) as they are streaming "snapshots" (every 300 ms or so) of aggregated trades data instead of trade by trade information.

And while companies such as Rithmic or CQG are streaming the required real time bid/ask information for each trade, their servers are not necessarily optimized for efficient historical data backfill, as their primary purpose is first to ensure a stable connection to the exchange and very fast order routing and execution services. Moreover, their tick data coverage is typically limited to the duration of the front-month contract or even less. Therefore, to fully benefit from the power of Investor/RT market analysis tools, adding the DTN MA service is a must, as it will allow you to connect seamlessly to the DTN historical data servers for any backfill request.

Moreover, Rithmic has a set a given limit about the amount of historical tick data you are entitled to download over a 7 days period. Unfortunately, It is impossible to monitor how much quota you have already used.

See Broker Data vs. Other Feeds for a detailed comparison between real time live data sources such as DTN IQ feed and traditional brokerage feed (Interactive Brokers, TDA/TOS) or web based solutions (TradingView)

What does it cost?

The cost is 15 $/month (10 $/month for Investor/RT pro subscriber). The feature can be enabled at any time by logging into your account on this website. (This fee is waived for Investor/RT trial users)

For your information

Approximately 90% of our brokerage feed clients use DTN MA for backfill, a good indication of its value.

How does it work?

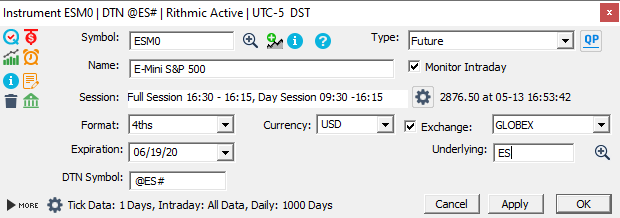

The integration with DTNMA is smooth and seamless. You will always use your broker symbols for real time data but, when your license includes the DTN MA add-on, all historical backfill requests are routed to DTN historical servers (and not to your brokerage datafeed servers). During the initial Investor/RT installation (or whenever you monitor/trade for the first time a new market), make sure that the correct DTN symbol is included in the instrument setup window (that you may access by pressing Alt-A).

Please note that the DTN symbol is set up once for all as this is the continuous (backadjusted) contract symbol that will be kept whenever you will proceed with the rollover process.

Where can I find DTN Symbols?

You can view a list of the most often traded symbols using our IQ feed Symbol Guide. For a more exhaustive list of symbols, visit the DTN website.