This post will provide up-to-date information on the most frequently asked questions about VolumeScope®. If you have a question that is not answered below, please post the question as a Reply to Topic.

This post will provide up-to-date information on the most frequently asked questions about VolumeScope®. If you have a question that is not answered below, please post the question as a Reply to Topic.

What is VolumeScope? VolumeScope allows users to view per-bar market data flow under a microscope, closely inspecting the volume-at-price data with great flexibility. For more details, visit the VolumeScope RTX Page and watch this Video Overview. For more information on the options available to VolumeScope, watch the Backgrounds, Text and Candles, and Scaling/Spacing videos on the Videos tab of the VolumeScope RTX Page

What is the cost of VolumeScope? The VolumeScope add-on is available for $30/month. Note that you must also have either the TPO Profile add-on or the Volume Analysis Package add-on in order to use VolumeScope.

How do I activate VolumeScope? Simply login to the site and from your user account, click on the Subscriptions tab, and then click the Manage Subscription button to add the VolumeScope package to your subscription. After adding VolumeScope to your subscription, within Investor/RT, choose File → License... from the main menu and deactivate and then reactivate your license to gain access to the new VolumeScope feature. You should then see VS in the green Status line indicating VolumeScope is activated.

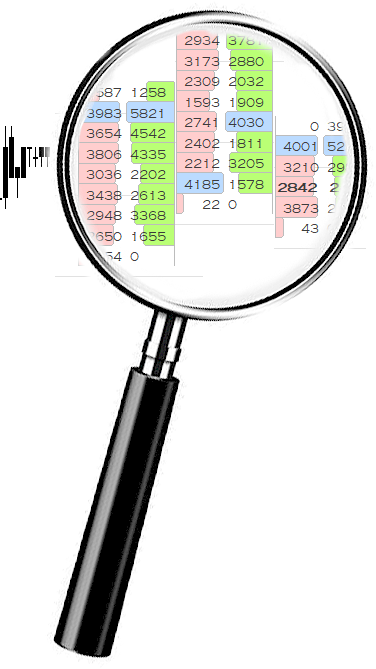

In VolumeScope 2.1, user may supply a weak side color when displaying text as "Bid x Ask Volume > Strong Side (Imbalance)" as seen in the image below. The Volume Background color (dark gray) is used to color constant shaded blocks behind the text. Imbalance is idenfied using the Strong Side mimumum settings: Strong side must be 175% the volume of the weak side and the weak side must have a minimum of 25 contracts (These values can be specified as C# variables and dynamically adjusted with buttons). Strong side is highlighted with the bid (red) and ask (green) colors, while the corresponding weak side is highlighted with the weak color (blue). All other text is colored with the text color (light gray).

In this chart definition, buttons are available at top to control the Imbalance Percent (C#1) and Imbalance Weak Side Minimum (C#2): https://www.linnsoft.com/charts/volumescopeimbalanceweak-es

Imbalance compares the ask volume (or buying volume) at one price to the bid volume (or selling volume) of the price below it. The reason two consecutive prices are used in this comparison instead of the same prices - while buying is occurring at the ask, selling is occuring at the price below it (bid). When auction is occurring between two prices (bid and ask), Imbalance seeks to identify and highlight the auctions where there was a clear winner on one side.

Imbalance may be highlighted in VolumeScope using either the background layer or the text layer, but this post will focus on the text layer. The relevant settings of the text layer can be seen below.

Text is turned on and set to show "Bid x Ask Volume" with the bid volume showing to the left of the x and ask volume showing to the right of the x. The color is set to "Strong Side (Imbalance)" which is the trigger to higlighting the strong and weak sides of imbalance. The image below shows one 1-minute bar of VolumeScope using the settings above. The Strong Side minimum percent is set to 175% and the minimum weak side volume is set to 25 contracts. Buy or Ask Imbalance will be identified when the ask volume at one price is at least 175% of the bid volume of the price below it. Ask Imbalance will highlight the ask volume (strong side) with the ask color (green) and the corresponding weak bid volume will be highlighted with the weak color (blue). Sell or BId Imbalance will be identified when the bid volume at one price is at least 175% of the ask volume of the price above it. Bid Imbalance will highlight the bid volume (strong side) with the bid color (red) and the corresponding weak ask volume will be highlighted with the weak color (blue). The rest of the text (neither strong nor weak) will be printed using the "Text" color.

Notice the red 280 bid volume is > 175% of the 114 ask volume above it. The percentage is actually 100 * 280/114 = 245.6%. And the weak side volume also meets the minimum criteria of at least 25 contracts. Therefore, 280 is highlighted as strong color in red and 114 is highlighted as weak color in blue. At the lowest 2 prices, the ask volume of 219 is 561% of 39 meeting the criteria for Buy Side Imbalance so 219 is highlighted in the ask color (green) and 39 is highlighed with the weak color (blue). Both the Imbalance Percent and the Weak Side Minimum Volume may be specified as C# variables and controlled dynamically with a button indicator as they are in this chart: https://www.linnsoft.com/charts/volumescopeimbalanceweak-es

The Price Volume Pattern (RTX) Indicator can identify single or multi-price imbalance. The configuration seen below identifies clusters where 2 or more consecutive prices have ask (buy) volume imbalance, and highlights those clusters with a yellow hollow box. It looks for Ask Volume > C#1 % of Bid Vol P1-. When a minus sign appears next to a price (P1-), this conveys that it is grabbing the price below. P1+ would grab the data of the price above. The addition condition ensures minimum volume on the weak side "Bid Vol- > C#2". Again, the minus sign at end of Bid Vol- results in accessing the bid volume of the price below the ask volume. PVP identifies all areas where there is a Cluster of 2 or more of these within any given bar. A bar may have multiple clusters.

Chart definition: https://www.linnsoft.com/charts/volumescopemultipriceimb-es

It is possible to have multiple clusters within a single bar, and both bid and ask imbalance clusters in the same bar. In the image below, two bid imbalance clusters (red) and one ask imbalance (green) occur in the same bar. with one bid cluster and one ask cluster actually sharing a price (266 x 505). This is possible because the bid volume of that price is being compared with the ask volume of the price above it (266 > 70), while the ask volume of that price is being compared with the bid volume of the price below it (505 > 211).

A 3rd instance of PVP could be added to the chart to highlight situations where one price is participating in both bid and ask imbalance. The PVP settings for such a setup are provided below.

The Multiple Price Highlighter (MPH) has the ability to identify key prices such as Buy Imbalance, Sell Imbalance, Unfinished Business, and Volume POC, and then extend those prices while naked. The image below shows the MPH setup for all 4.

Notice that all have "Extend Naked Last 2 Days" turned on so each key level of the past 2 days will be extended while naked. Volume POC looks for "Highest 1 Price of Volume". Unfinished Business looks for a high with sell volume > 0 or a low with buy volume > 0. Buy (Ask) and Sell (Bid) Imbalances have been defined in previous posts above and are again dynamically using the C#1 value for Imbalance Percent and C#2 for Minimum Weak Side Volume (which are controlled by the buttons). Notice the filter on each which accounts for the weak side minimum volume. Unfinished Business and VPOC are drawn with hollow boxes so that they may share prices with Buy and Sell Imbalance with both being clearly visible. Below is the chart image and chart definition.

Chart Definition: https://www.linnsoft.com/charts/volumescopeextendkeyprices-es

Users may color the background based on volume level using the Multiple Price Highlighter Indicator (MPH). In the chart below, there are 5 instances of MPH in the chart, each with it's own volume level. The buttons at the top control each volume level (via C# variables). Gold colors prices with volume > 1000. Blue colors prices > 500. This chart is setup with 5 levels but any number of levels may be implemented. To adjust the colors of each level, simply shift-double-click on any colored price in the chart and change the respective color within the MPH preferences (and right-click on the respective button at top and choose Edit Button and change button color accordingly).

Chart Definition: https://www.linnsoft.com/charts/voumescope-volumelevels-es

Thanks Chad............excellent and very useful chart!

Great overview, thanks. A dynamic C variable to set the magnitude of imbalances would be great. Maybe something like the average of the last X imbalances, and then calculate 2X, 3X and 4X.

E.g. in the last chart (Using MPH for Volume Levels) , there are 11 traded prices. The absolute values of the imbalances are:

0

45

183

276

313

148

264

207

386

125

92

So the average would be 185. I tried to access the individual imbalances but could not find any way to do it.

If you compute the average volume at price (which can be done directly with VPS indicator as seen below), you can probalby do something like multiply that by 0.50 to get a very good approximation for average imbalance magnitude.

Great idea, thanks!

Hello. This is much better than the videos I've watched, as you go into more detail Chad.

Are there any resources directly related to trading imbalances, and which settings suite certain strategies and products?

Thanks

Pages